The Comprehensive Guide to Appliance Repair

Introduction to Appliance Repair

In today’s fast-paced world, our homes are filled with various appliances that simplify our daily tasks. From refrigerators to washing machines, these devices play a crucial role in maintaining a comfortable lifestyle. However, when an appliance breaks down, it can disrupt our routine and lead to unexpected expenses. Understanding the basics of appliance repair can be a valuable skill, saving both time and money. This guide delves into the essentials of appliance repair, providing insights into common issues and solutions.

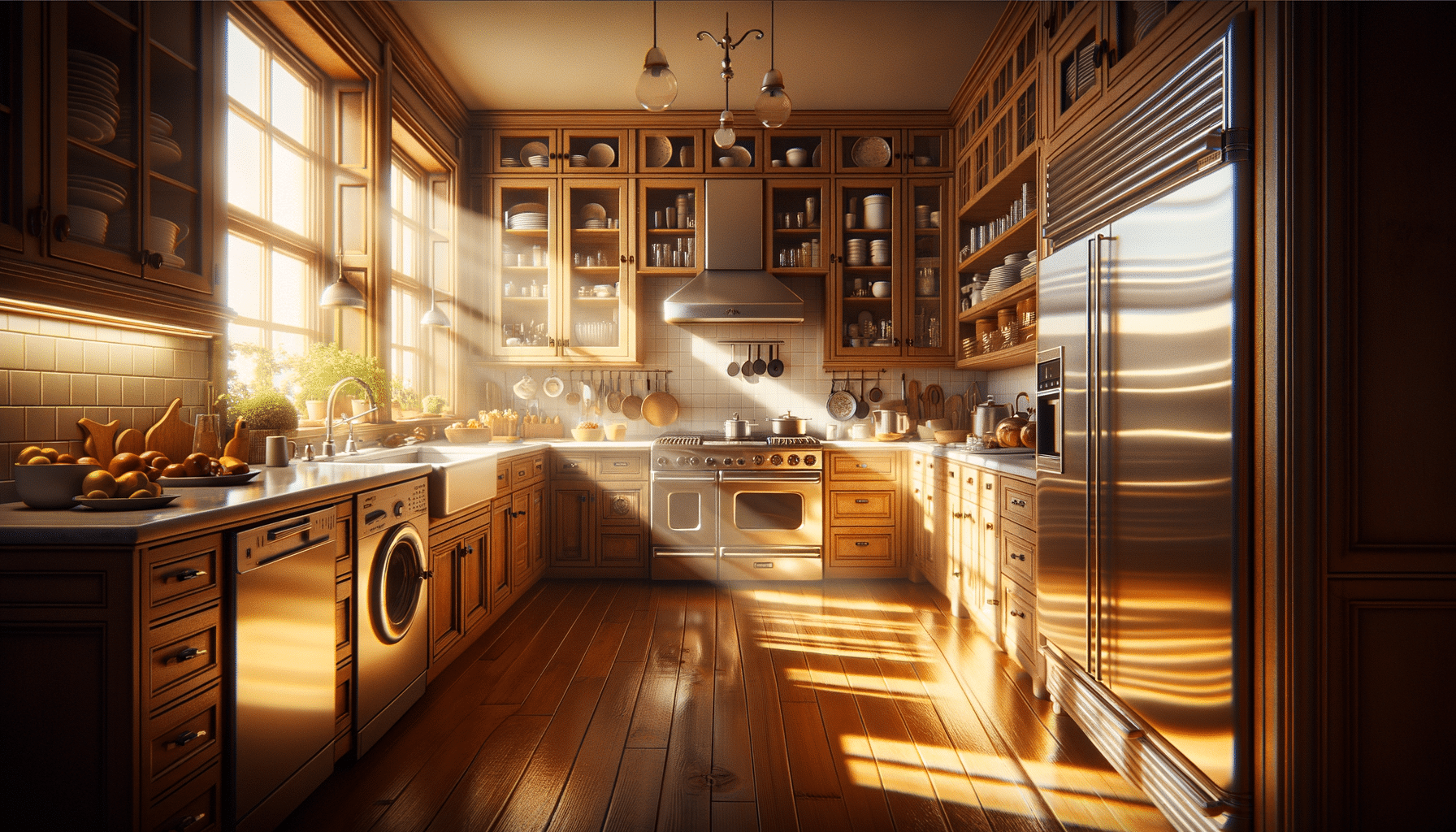

Common Appliance Issues and Solutions

Appliances can malfunction for various reasons, ranging from electrical issues to mechanical failures. Identifying the root cause is the first step in appliance repair. Common problems include:

- Refrigerator not cooling: This could be due to a faulty thermostat or blocked vents. Cleaning the coils and checking the thermostat settings can often resolve this issue.

- Washing machine leaks: Leaks may occur due to worn-out hoses or a damaged door seal. Inspecting these components regularly can prevent water damage.

- Oven not heating: A defective heating element or malfunctioning thermostat might be the culprit. Replacing these parts can restore the oven’s functionality.

By understanding these common issues, homeowners can perform basic troubleshooting, potentially avoiding costly professional repairs.

The Benefits of DIY Appliance Repair

Taking a DIY approach to appliance repair offers several benefits, including:

- Cost savings: Performing minor repairs yourself can significantly reduce expenses compared to hiring a technician.

- Convenience: Immediate repairs mean you don’t have to wait for a professional appointment, minimizing downtime.

- Skill development: Each repair enhances your understanding and skills, making future issues easier to handle.

However, it’s essential to recognize your limits. Complex repairs involving electrical components or gas lines should be left to professionals to ensure safety.

When to Call a Professional

While DIY repairs can be effective for minor issues, some situations necessitate professional intervention:

- Electrical problems: If an appliance repeatedly trips circuit breakers or shows signs of electrical malfunction, it’s best to consult a professional.

- Gas appliances: Repairs involving gas lines should always be handled by certified technicians to prevent hazardous leaks.

- Complex mechanical failures: If a repair requires specialized tools or knowledge, a professional’s expertise is invaluable.

Knowing when to call a professional not only ensures safety but can also prevent further damage to the appliance.

Conclusion: The Value of Appliance Repair Knowledge

Understanding appliance repair is a practical skill that can enhance your ability to maintain a functional home. By learning to troubleshoot common issues and recognizing when to seek professional help, you can ensure your appliances serve you well for years to come. This knowledge empowers you to make informed decisions, balancing DIY efforts with professional services to keep your household running smoothly.